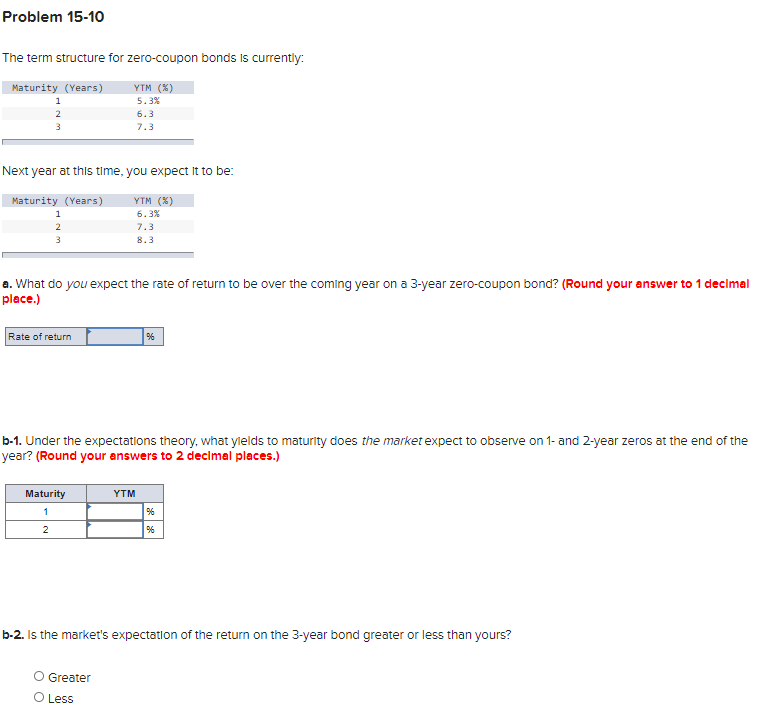

42 ytm for zero coupon bond

Current yield - Wikipedia When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM; par: YTM = current yield = coupon yield. For zero-coupon bonds selling at a discount, the coupon yield and current yield are zero, and the YTM is positive. See also. Adjusted current yield; References. Current Yield at … What is the yield to maturity (YTM) of a zero coupon bond with a face ... Answer (1 of 2): YTM is 5.023%. Bond mathematics tend to be easier to calculate on a spreadsheet as seen below: Calculated the Yield first using RATE function. Parameters can be found out using the 'fx' button in MS Excel. You can see the parameters used in the above image as well viz. B6*B7 ->...

Solved What is the YTM for a zero coupon bond ($1,000 par) - Chegg Finance. Finance questions and answers. What is the YTM for a zero coupon bond ($1,000 par) maturing 18 months and 15 days from now selling for $900 today. Use semiannual rate approach. A. 7.19% B. 8.41% C. 6.94% D. 6.53% E. 7.81%. Question: What is the YTM for a zero coupon bond ($1,000 par) maturing 18 months and 15 days from now selling for ...

Ytm for zero coupon bond

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Solved Consider a zero-coupon bond with a yield to maturity | Chegg.com Consider a zero-coupon bond with a yield to maturity (YTM) of 4%, a face value of $1000, and a maturity date 5 years from today. Question: Consider a zero-coupon bond with a yield to maturity (YTM) of 4%, a face value of $1000, and a maturity date 5 years from today. Bond Formula | How to Calculate a Bond | Examples with Excel … On the other hand, the formula for zero-coupon bond (putting C = 0 in the above formula) is represented as, ... Step 4: Next, determine the YTM of the bond on the basis of the return currently expected from securities with similar risk profiles. The YTM is denoted by r. Step 5: Next, determine the number of coupon payments to be paid during a year, which is denoted by n. To …

Ytm for zero coupon bond. Zero Coupon Bonds - Financial Edge What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value. Calculating yield-to-maturity or expected returns. Yield to maturity (YTM) is the expected return on a bond if it is held until maturity. Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL - YouTube In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · For example, if interest rates go up, driving the price of IBM's bond down to $980, the 2% coupon on the bond will remain unchanged. When a bond sells for more than its face value, it sells at a ...

Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). ytmZeroCouponBond: Calculates the Yield-To-Maturity(YTM) of a Zero ... Details. The method ytmZeroCouponBond() is developed to compute the Yield-To-Maturity a Zero-Coupon Bond. So, ytmZeroCouponBond() gives the Price of a Zero-Coupon Bond for values passed to its three arguments. Here, maturityVal represents the Maturity Value of the Bond, n is number of years till maturity, and price is Market Price of Zero-Coupon Bond. The output is rounded off to three decimal ... How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula... Zero Coupon Bond: Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds ...

Finding Ytm Of A Zero Coupon Bond 6 2 1 Youtube - Otosection to find the yield to maturity (ytm) and to make it more general for maturity dates less than one year: ytm = [ (f p) p] * (365 d) where d is number of days until maturity. the last term is the adjustment to put it into apr. Zero-Coupon Bond Definition - Investopedia The interest earned on a zero-coupon bond is an imputed interest, meaning that it is an estimated interest rate for the bond and not an established interest rate. For example, a bond with a face... Zero Coupon Bond Calculator - Nerd Counter Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ...

YTM for a zero coupon bond? | Forum | Bionic Turtle so, yeild (YTM) = r = LN (F/P)*1/T; i.e., given the three unknowns, there is only one yield ...and similar logic for discrete frequencies ...Re: "zero coupon bond has just one payment," totally agree

Calculating YTM of Coupon Bond based on Information from Zero Coupon ... The following table summarizes prices of various risk-free, zero-coupon bonds (expressed as a percentage of face value, per $100 face value): Maturity (years) 1: $95.51 2: $91.05 3: $86.38 The YTM are as follows 1-year: 4.7% 2-year: 4.8% 3-year: 5% Given this information, what's the YTM of a...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity. The n is the number of years from now until the bond matures.

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below:

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1 The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate.

Bond Duration Calculator – Macaulay and Modified Duration YTM: The calculated yield to maturity of the bond; Annual Payments: How many coupon payments the bond makes a year; Example: Compute the Modified Duration for a Bond. Let's extend the above example (from the Macaulay section) for a bond with the following characteristics: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to ...

Coupon vs Yield | Top 5 Differences (with Infographics) Suppose the face value of an XYZ bond is $1000, and the coupon payment is $40 annually. The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. Suppose the annual coupon of a bond is $40. And the price ...

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

What is a Zero Coupon Bond? Who Should Invest? | Scripbox For example, if the bond's face value is Rs.100, and it pays an interest of 8%. Here, the interest rate is the bond coupon. What is yield to maturity for a zero coupon bond? Yield is a measure of all the cash flows of an investment over a period of time. It considers all the coupon payments and dividends received during the term of an investment.

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. The prevailing market ...

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Bond Formula | How to Calculate a Bond | Examples with Excel … On the other hand, the formula for zero-coupon bond (putting C = 0 in the above formula) is represented as, ... Step 4: Next, determine the YTM of the bond on the basis of the return currently expected from securities with similar risk profiles. The YTM is denoted by r. Step 5: Next, determine the number of coupon payments to be paid during a year, which is denoted by n. To …

Solved Consider a zero-coupon bond with a yield to maturity | Chegg.com Consider a zero-coupon bond with a yield to maturity (YTM) of 4%, a face value of $1000, and a maturity date 5 years from today. Question: Consider a zero-coupon bond with a yield to maturity (YTM) of 4%, a face value of $1000, and a maturity date 5 years from today.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 ytm for zero coupon bond"