41 what is coupon for bond

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail. Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, and ...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

What is coupon for bond

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. I bonds — TreasuryDirect Tax information for EE and I savings bonds. Using savings bonds for higher education. How much does an I bond cost? Electronic I bonds: $25 minimum or any amount above that to the penny. For example, you could buy an I bond for $36.73. Paper I bonds: $50, $100, $200, $500, or $1,000. home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016

What is coupon for bond. › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ... Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM, the bond price is less than the face value, and as … PIMCO 25+ Year U.S. Treasury Index ETF's Underperformance Explained Looking through bond fund screeners, the PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund ( NYSEARCA: ZROZ) caught my eye. ZROZ has been the worst-performing bond fund of the ... Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. Bond Discount - Investopedia 29.05.2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ... Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: › terms › zWhat Is a Zero-Coupon Bond? - Investopedia Payment of interest, or coupons, is the key differentiator between a zero-coupon and regular bond. Regular bonds, which are also called coupon bonds, pay interest over the life of the bond and also...

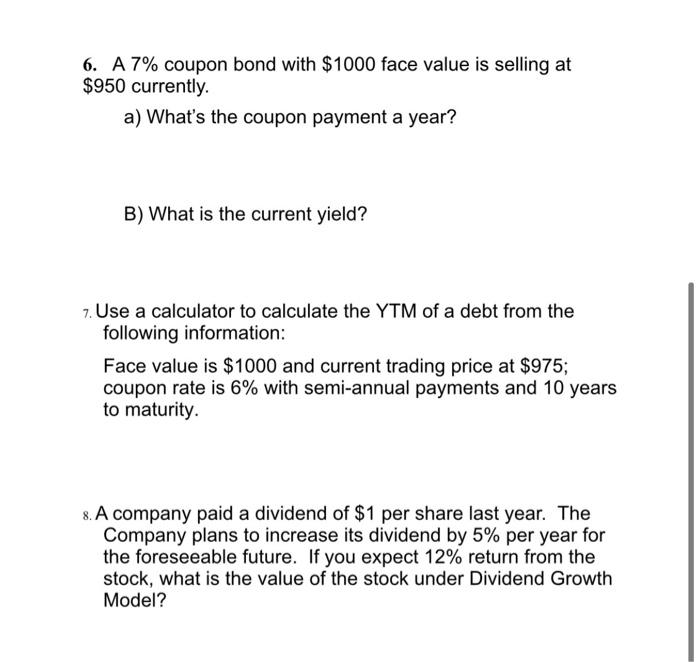

Coupon Rate Calculator | Bond Coupon A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. We usually calculate it as the product of the coupon rate and the face value of the bond. How often do I receive coupons from investing in bonds? The short answer is it depends on the bonds that you invest in. Coupon (Bonds) - Explained - The Business Professor, LLC A coupon is the amount an investor receives for each acquired bond depending on the percentage initially associated with it. For instance, a bond with a face value of $5000 at 4% interest yield per annum will pay a coupon of $200 yearly and $100 per coupon payment since it is done semi-annually. The ability to trade bonds before they mature ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value... Important Differences Between Coupon and Yield to Maturity - The Balance To put all this into the simplest terms possible, the coupon is the amount of fixed interest the bond will earn each year—a set dollar amount that's a percentage of the original bond price. Yield to maturity is what the investor can expect to earn from the bond if they hold it until maturity. Do the Math

Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid.

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA The term "coupon bond" (CB) refers to the type of bond which includes coupons that are paid periodically (mostly semi-annual or annual) from the time of issuance until the maturity of the bond. These bonds come with a par value and a coupon rate, which is the bond's yield at the time of issuance.

› articles › bondsUnderstanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. Although a bond's coupon rate is fixed, the price of a bond sold in secondary markets can fluctuate.

Coupon Bond Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying you $50 per year. To claim your interest payment, you would simply clip off the ...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

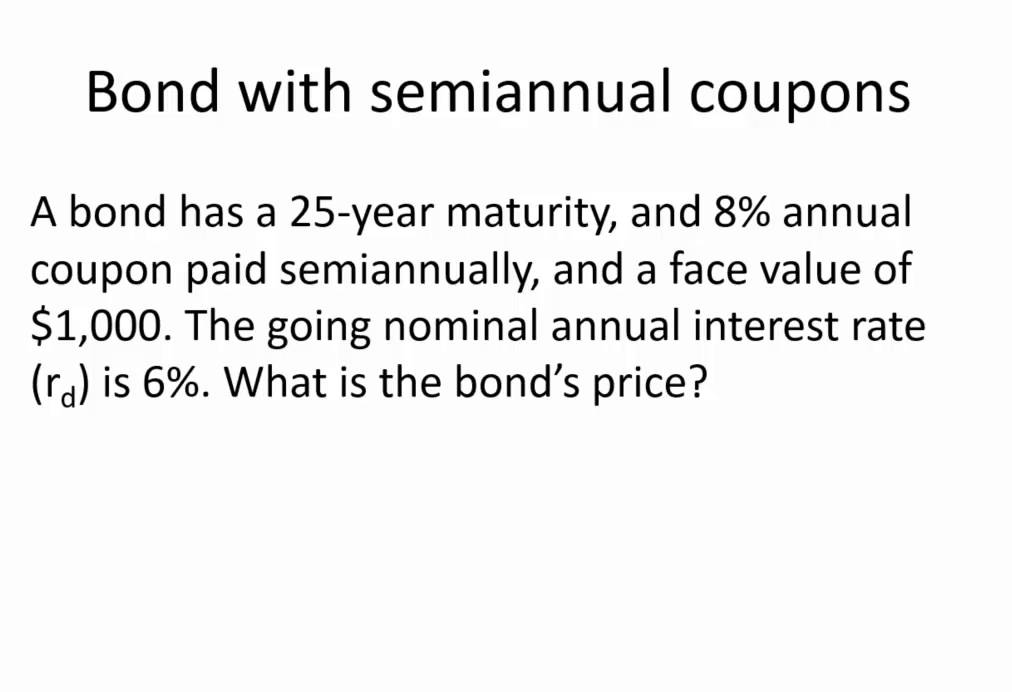

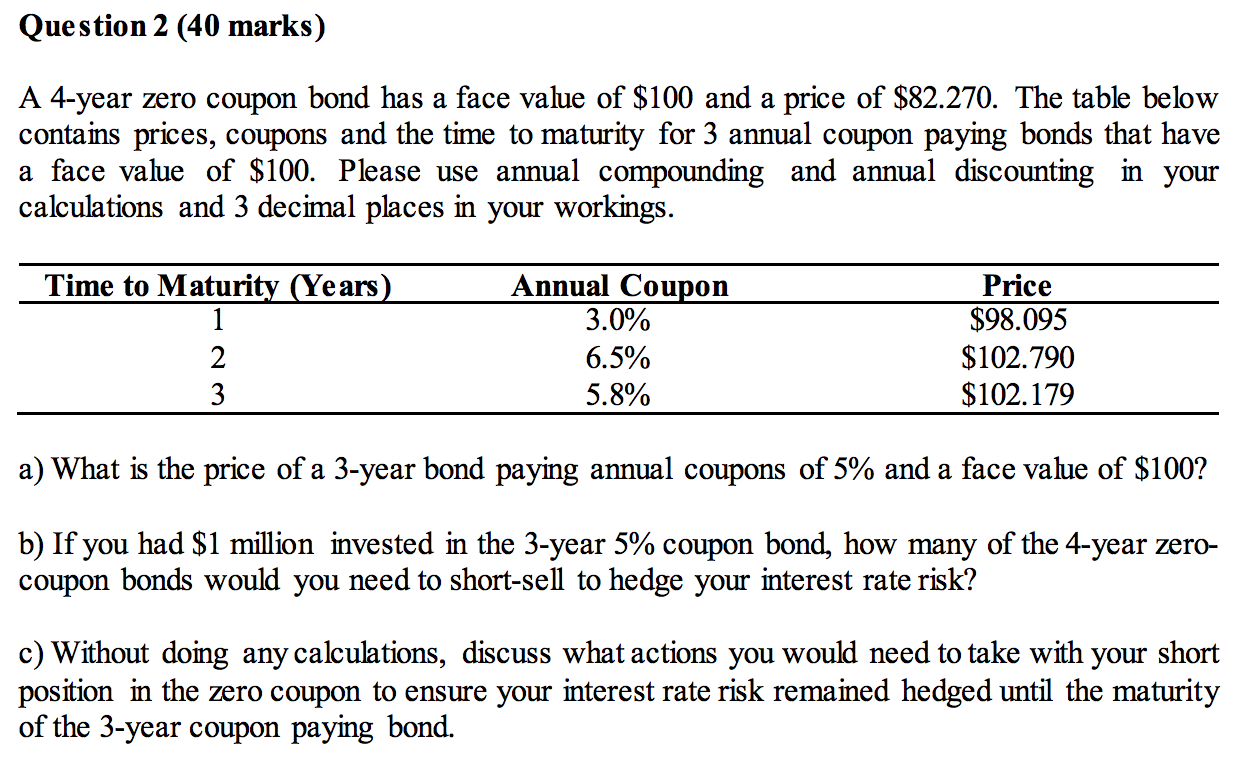

Chapter 4 - Valuation and Bond Analysis - Business Finance Essentials Chapter Learning Objectives. Define valuation and identify the three steps in the valuation process. Calculate the value of a bond given the coupon rate, required return, and time to maturity of the bond. Identify the three primary relationships between bond prices and interest rates. Explain the concept of the yield-to-maturity and calculate ...

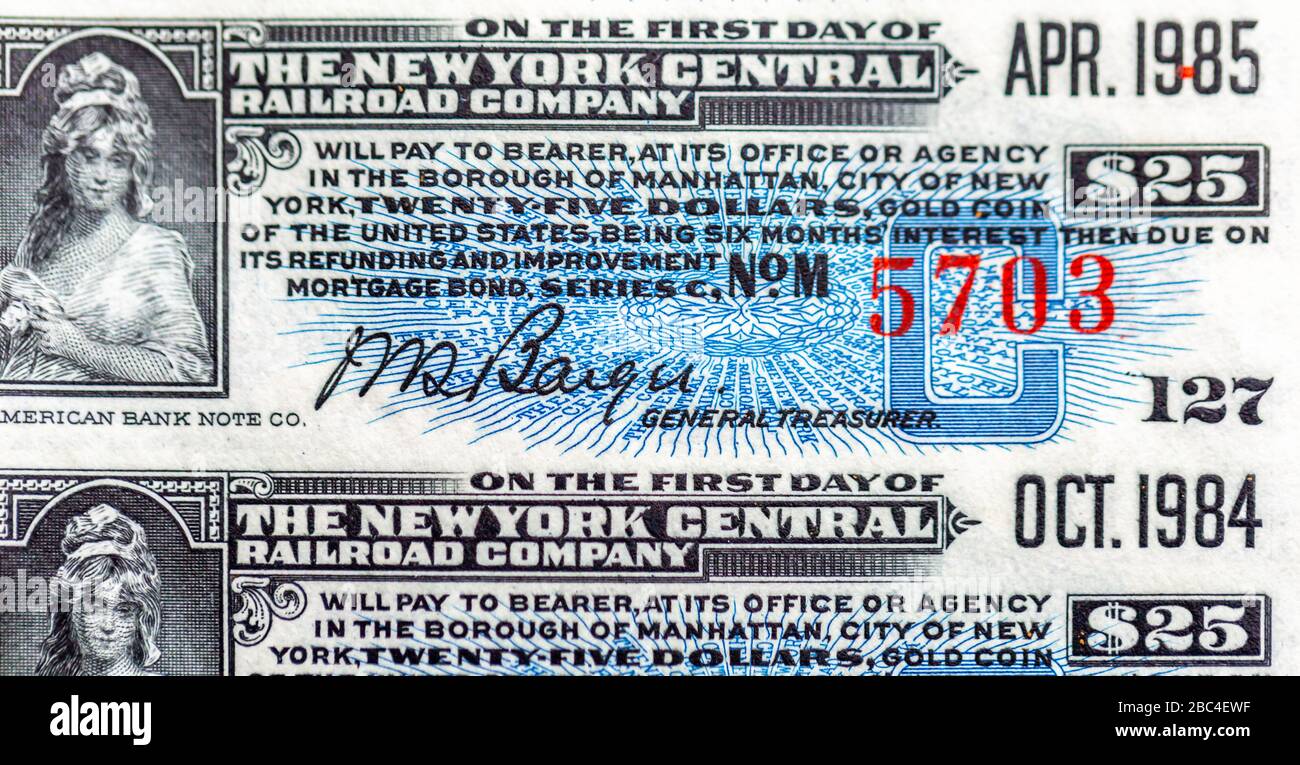

› terms › cCoupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of...

Coupon Bond - Definition, Terminologies, Why Invest? - WallStreetMojo A coupon bond is a good way of increasing your income over a period of time. Coupon bonds are subjected to taxation in the US. Hence they can be held in a tax-deferred retirement account in order to save investors on paying taxes on the future income.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep A Zero-Coupon Bond is priced at a discount to its face (par) value with no periodic interest payments from the date of issuance until maturity. Zero-Coupon Bond Features How Do Zero Coupon Bonds Work? Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity.

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ...

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price ... What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds

What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it.

Zero Coupon Bond | Investor.gov Glossary Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

› coupon-bond-formulaHow to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security).

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016

I bonds — TreasuryDirect Tax information for EE and I savings bonds. Using savings bonds for higher education. How much does an I bond cost? Electronic I bonds: $25 minimum or any amount above that to the penny. For example, you could buy an I bond for $36.73. Paper I bonds: $50, $100, $200, $500, or $1,000.

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity.

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "41 what is coupon for bond"