38 present value of coupon bond calculator

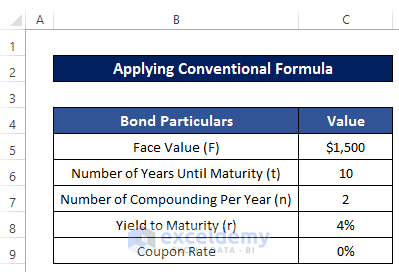

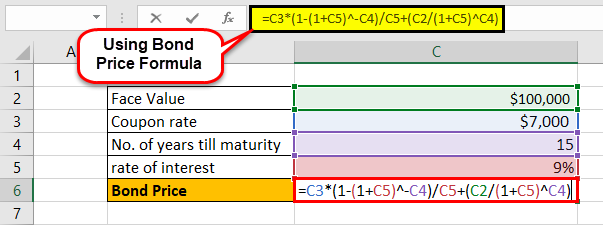

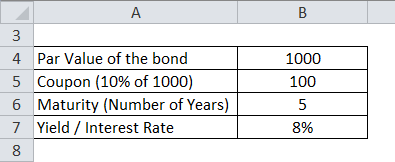

Present Value Of Bond Coupon Payment Calculator Bond Present Value Calculator - UltimateCalculators.com. CODES (5 days ago) Present Value of a Bond. Present Value of a bond is used to determine the current market price of a bond, that may pay regular interest payments, and is redeemable at some time in the … Visit URL. Category: coupon codes Show All Coupons Bond Price Calculator - Present Value of Future Cashflows - DQYDJ You will want to start by creating a spreadsheet such as the above. nclude the parameters we have in the calculator on this page - Face Value, Coupon Rate, Market Interest Rate (or Discount Rate ), Years to Maturity and Payments per Year. Then you should use the 'PV' formula (use ';' to separate inputs in OpenOffice, use ',' in Excel).

How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a...

Present value of coupon bond calculator

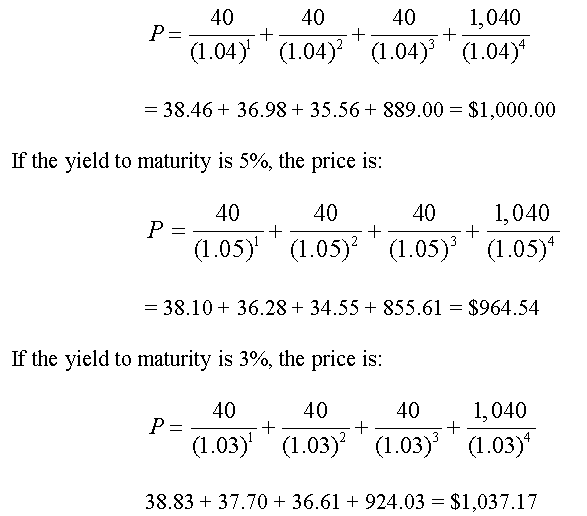

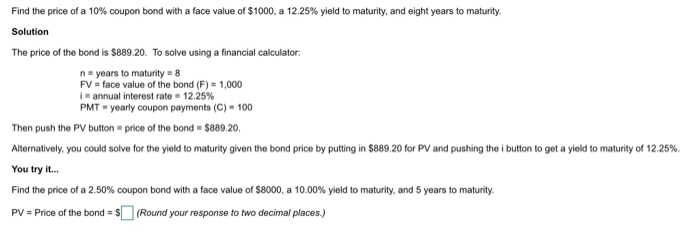

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Calculate bond value with discount rate The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate.20. Calculating Yield to Maturity on a Zero-coupon Bond.This Frederick Macaulay calculator is used to ... Bond Present Value Calculator - stockmarketcalculators.com Here are bond present values for the above input values using different adjusted market rates. Bond Present Value Calulator Results Annual Coupon Payment ($)

Present value of coupon bond calculator. Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture. Present Value Calculator home / financial / present value calculator Present Value Calculator This present value calculator can be used to calculate the present value of a certain amount of money in the future or periodical annuity payments. Present Value of Future Money Future Value (FV) Number of Periods (N) Interest Rate (I/Y) Results Present Value: $558.39 2021. 2. 8. · NPV = Present - dyw.talkwireless.info We can use a bond price calculator to survey the damage using the following specs: 30-year bond. Face value: £100; Coupon rate2: 1%; Market rate: 2%; Years to maturity: 30; Dial that scenario into the calculator and it tells us the bond price falls from £100 to £77.52. Capital loss: -22.5%. A bond's Savings Bond Calculator — TreasuryDirect Note: The Calculator won't save an inventory you make with the Google Chrome or Microsoft Edge browser. The Savings Bond Calculator gives information on paper savings bonds of Series EE, Series I, and Series E, and on savings notes: Value today. Value on past dates. Value on future dates through the current six-month interest period

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. $1,000,000 / (1+0.03)20 = $553,675.75 Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments) Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

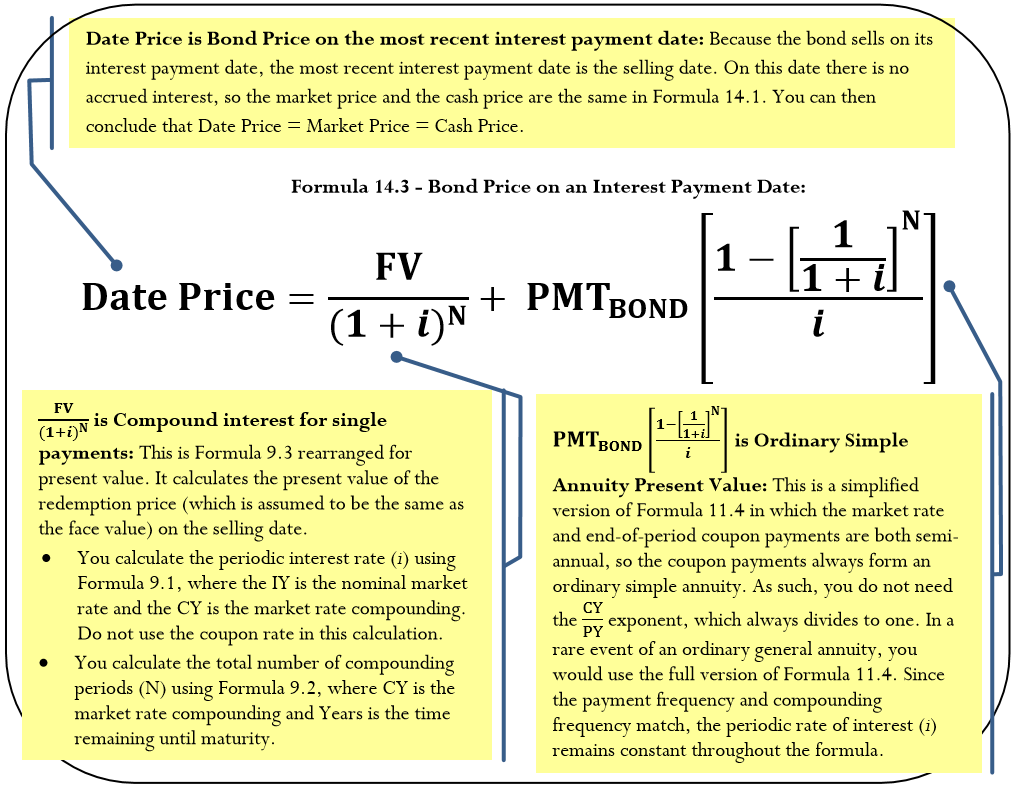

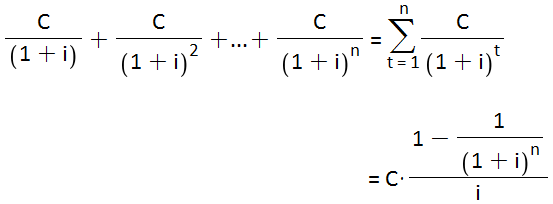

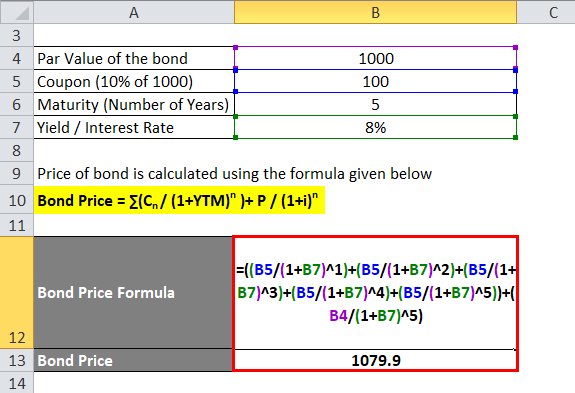

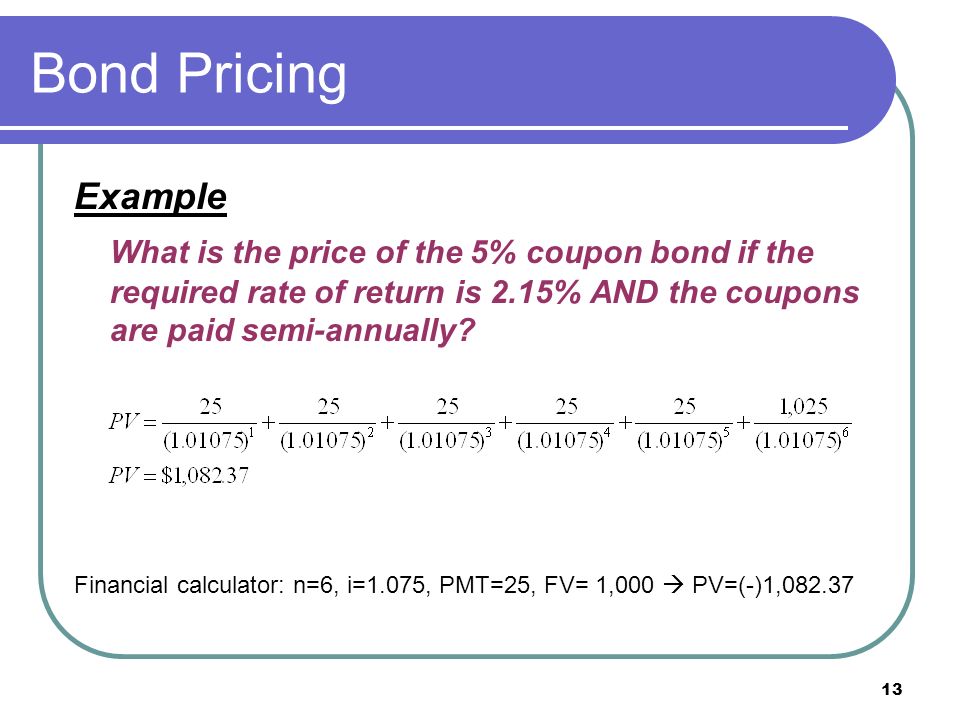

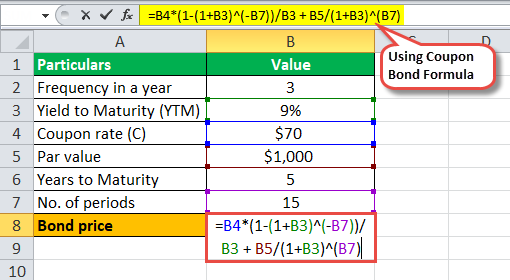

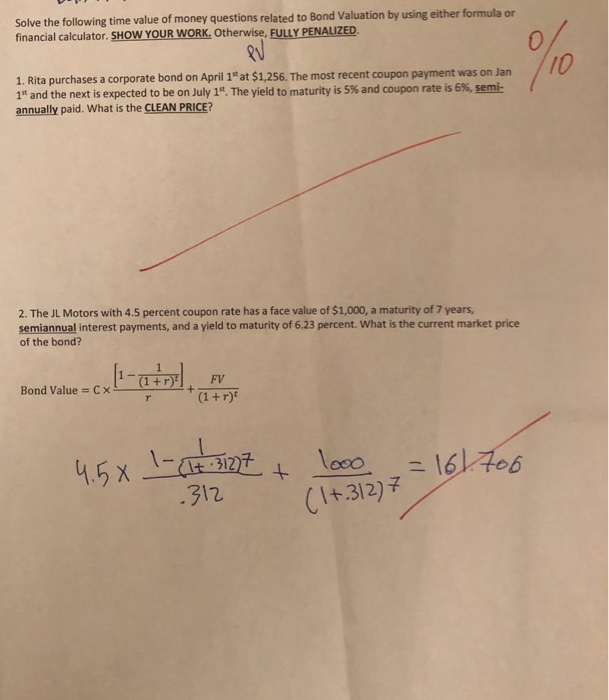

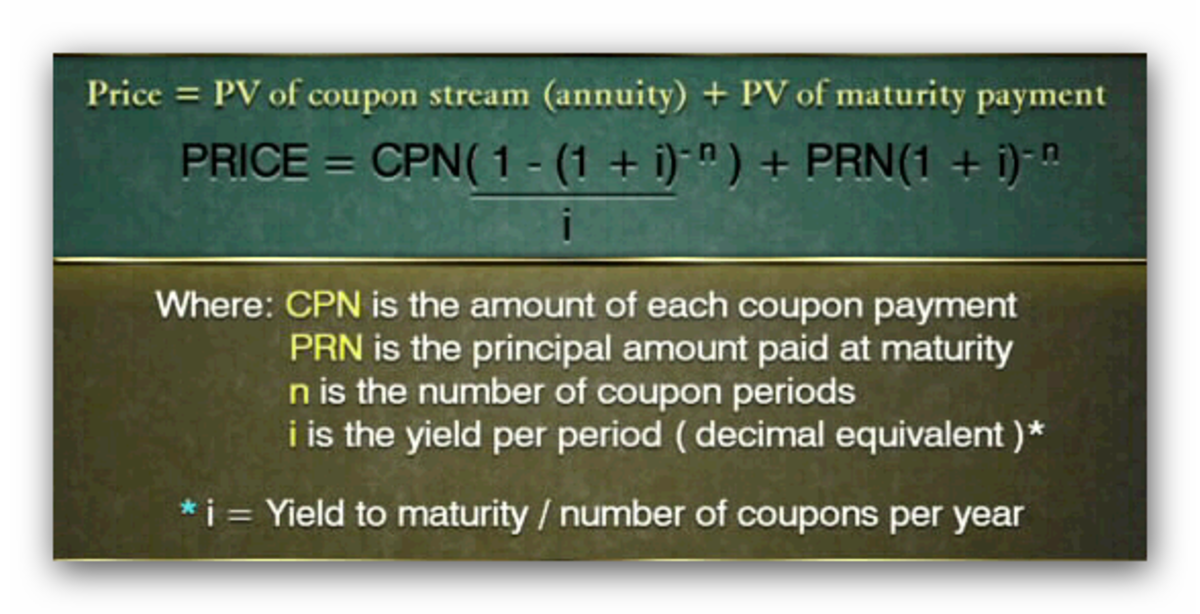

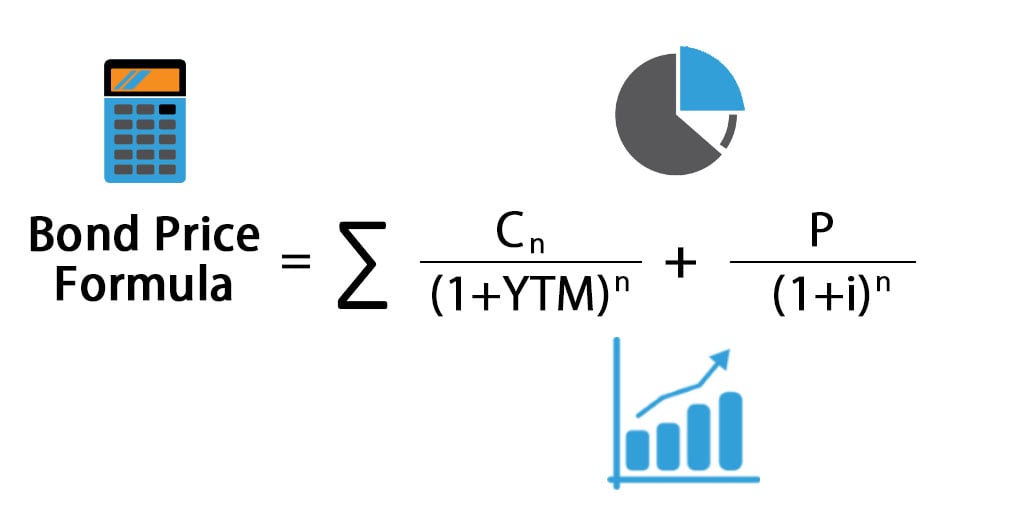

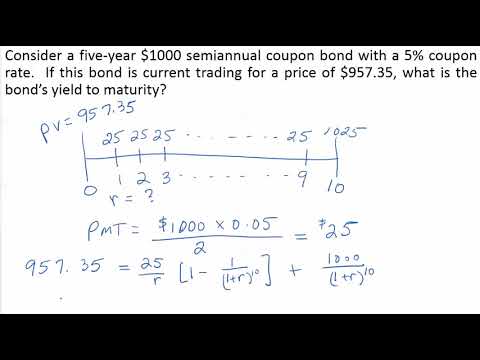

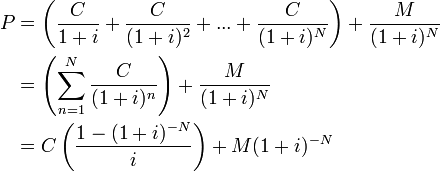

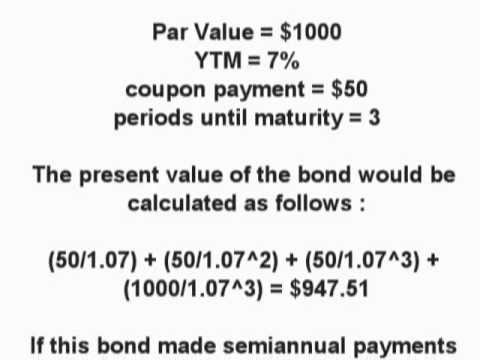

Coupon Payment | Definition, Formula, Calculator & Example Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator. Coupon Bond Present Value Calculator - bizimkonak.com Listing Websites about Coupon Bond Present Value Calculator. Filter Type: All $ Off % Off Free Shipping Bond Present Value Calculator. CODES (8 days ago) Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

Calculate the Value of Your Paper Savings Bond(s) - TreasuryDirect The Savings Bond Calculator WILL: Calculate the value of a paper bond based on the series, denomination, and issue date entered. (To calculate a value, you don't need to enter a serial number. However, if you plan to save an inventory of bonds, you may want to enter serial numbers.) Store savings bond information you enter so you can view or ...

Bond Present Value Calculator - UltimateCalculators.com Use the present value of a bond calculator below to solve the formula. Present Value of a Bond Definition Present Value of a Bond is the value of a bond equal to the discounted remaining interest payments and the discounted redemption value of the bond certificate. Variables PV of Bond=Current market value of bond

Bond Price Calculator F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity

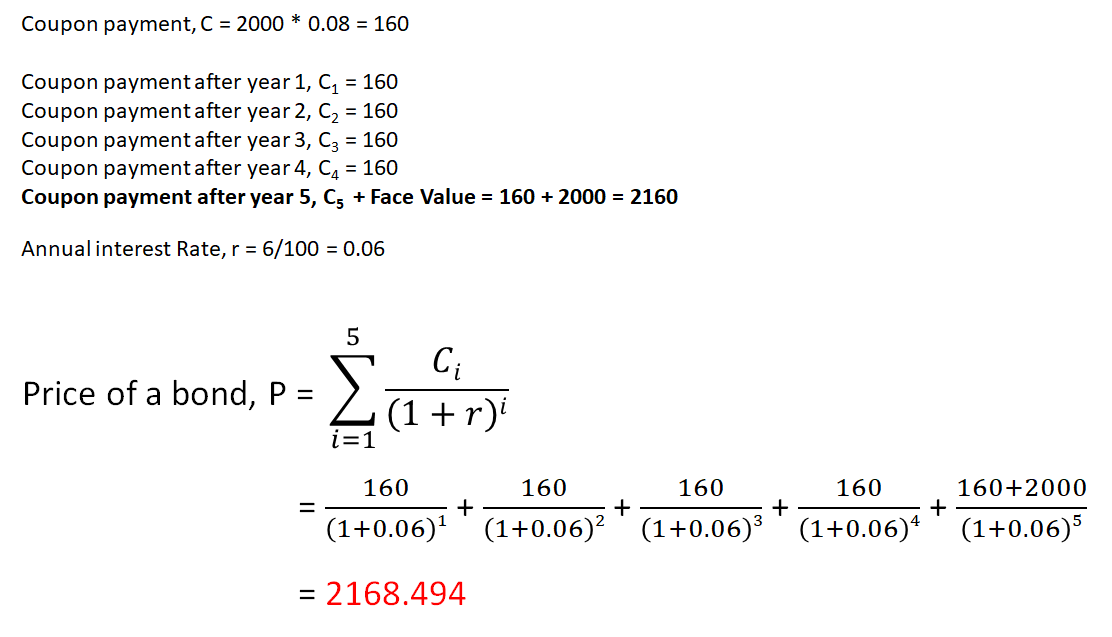

Present Value Coupon Bond Calculator - Bizim Konak How to Calculate Present Value of a Bond - Pediaa.Com. CODES (Just Now) The total present value of the bond can be represented as, Calculate Present value of a bond - Example: Following information is given with regard to the bond issue of ABC Company. Face value of the bond - $ 2000 Maturity period of the bond - 5 years Annual coupon ...

Bond Present Value Calculator - stockmarketcalculators.com Here are bond present values for the above input values using different adjusted market rates. Bond Present Value Calulator Results Annual Coupon Payment ($)

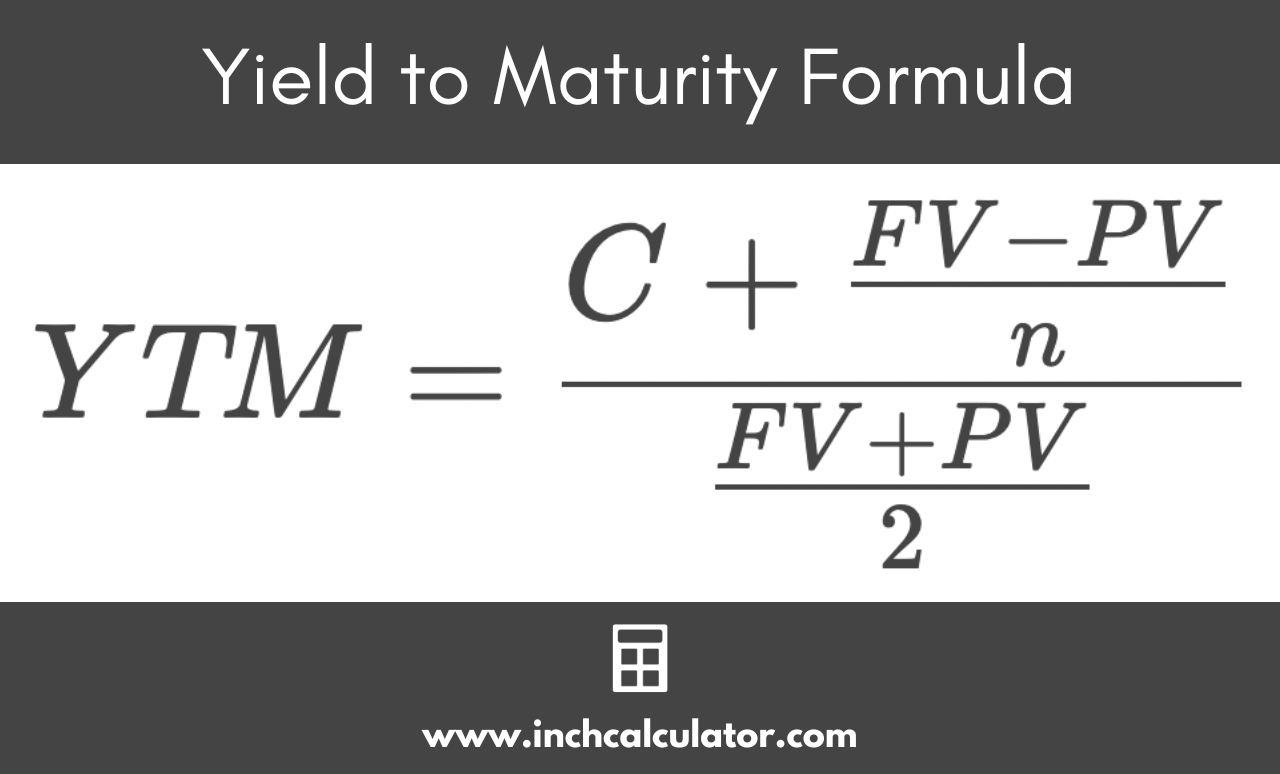

Calculate bond value with discount rate The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate.20. Calculating Yield to Maturity on a Zero-coupon Bond.This Frederick Macaulay calculator is used to ...

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "38 present value of coupon bond calculator"