43 coupon vs interest rate

How are bond yields different from coupon rate? The coupons are fixed; no matter what price the bond trades for, the interest payments always equal Rs 40 per year. The coupon rate is often different from the yield. A bond's yield is more ... Difference Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on. The coupon rate follows a formula to calculate the rate.

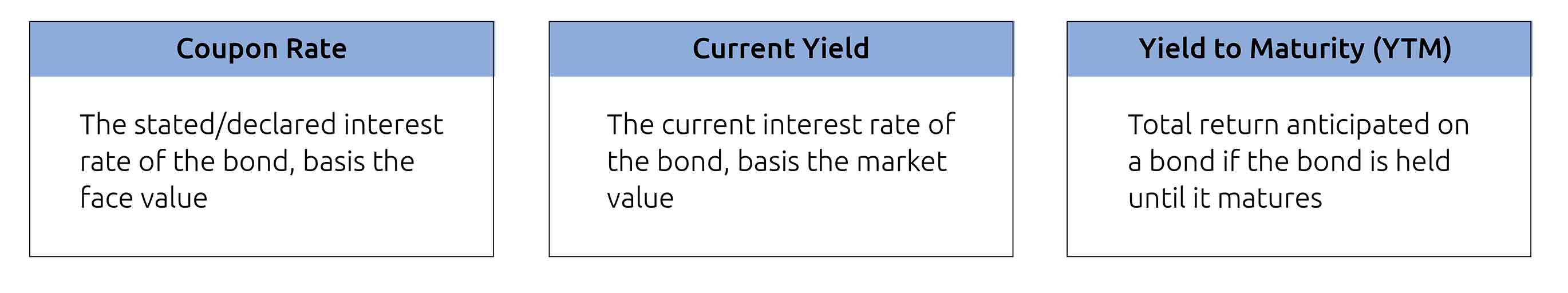

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Coupon vs interest rate

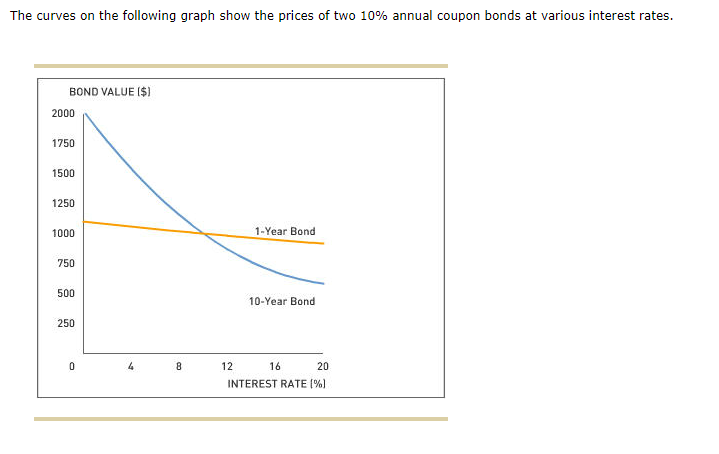

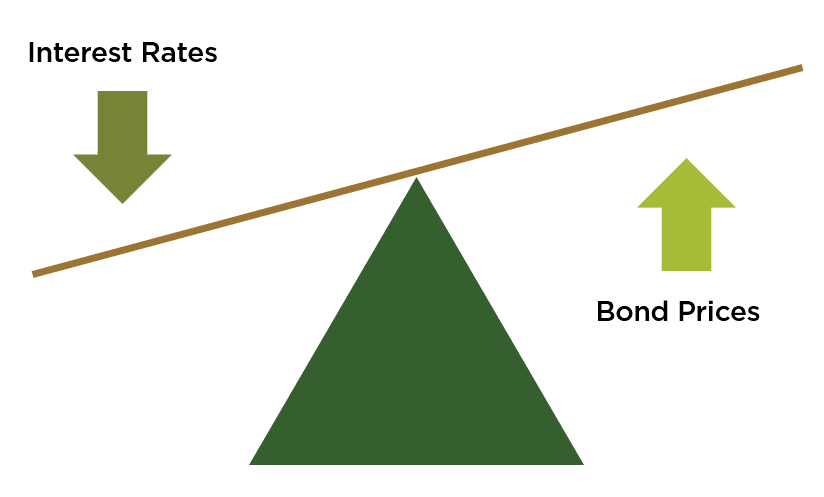

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity. Prevailing interest rates may rise or... Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Chapter 6 -- Interest Rates - California State University ... interest rates Interest rate price risk: an increase in interest rates causes a decrease in bond value Interest reinvestment risk: a decrease in interest rates leads to a decline in reinvestment income from a bond (2) If the required rate of return (or discount rate) is higher than the coupon rate, the value of the bond will be less than the ...

Coupon vs interest rate. Difference Between Coupon Rate and Required Return The main difference between Coupon Rate and Required Return is that coupon rate is the constant value paid by the bond issuer at regular intervals until the bond matures, whereas required return is the amount accepted by the investor for assuming the responsibility of the stock and as an amount of compensation. APR Vs. Interest Rate: What's The Difference? - Forbes Advisor APR, or annual percentage rate, is a calculation that includes both a loan's interest rate and a loan's finance charges, expressed as an annual cost over the life of the loan. In other words ... Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) The key differences between Coupon Rate vs. Interest Rate are as follows - The coupon rate is calculated on the face value of the bond , which is being invested. The interest rate is calculated considering the basis of the riskiness of lending the amount to the borrower. The coupon rate is decided by the issuer of the bonds to the purchaser. What is 'Coupon Rate' - The Economic Times Coupon rate is not the same as the rate of interest. An example can best illustrate the difference. Suppose you bought a bond of face value Rs 1,000 and the coupon rate is 10 per cent. Every year, you'll get Rs 100 (10 per cent of Rs 1,000), which boils down to an effective rate of interest of 10 per cent.

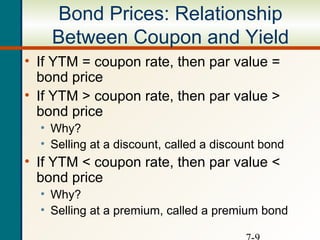

Important Differences Between Coupon and Yield to Maturity - The Balance Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, the coupon rate is fixed and stays the same throughout the life ... APR vs. Interest Rate: How are They Different? - MoneyWise The fees turn the interest rate into an APR of 3.37%. Loan B, which has an interest rate of 3%, 1 discount point costing $2,000, and $3,000 in other lender fees. The point and other fees turn the interest rate into an APR of 3.20%. Interest rates between the two loans differ by a quarter point (0.25). Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... Coupon rate refers to the fixed interest payments paid by the bond issuer and will be the same during the life of the bond. On the other hand, market interest rates might rise or fall and impact...

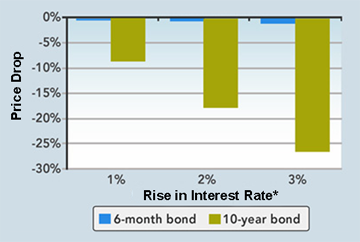

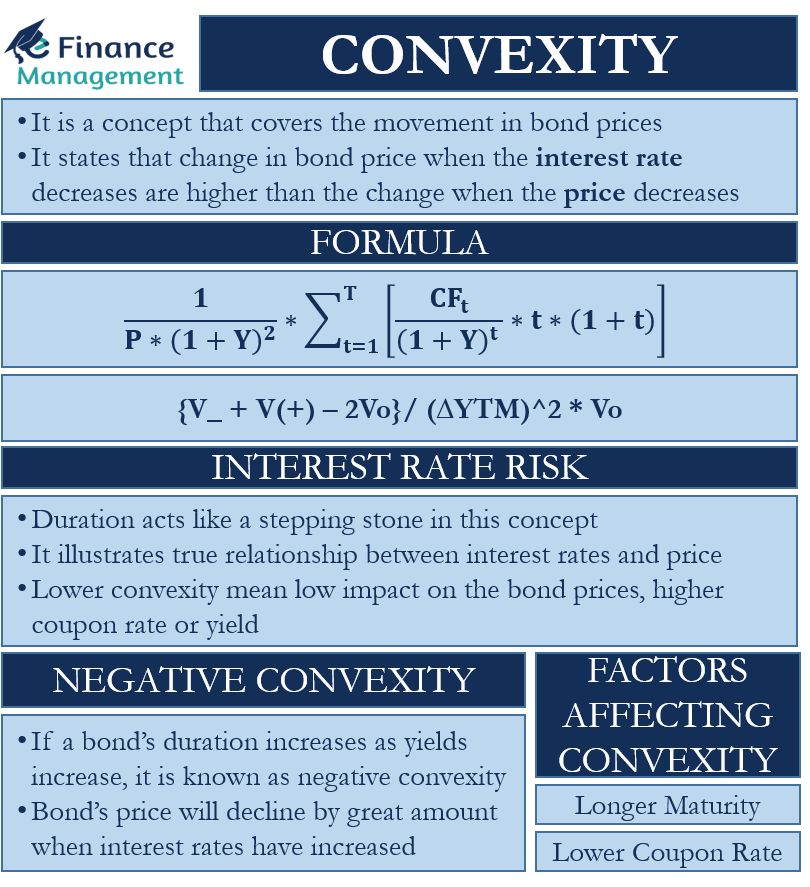

Reinvestment Risk (Coupon) vs. Interest Rate Risk (Zero-Coupon) The high "interest rate risk" is reflected in the 10 which tells you (if we temporarily round off the difference between the Mod and Mac duration, maybe the Mod duratoin is 9.5, so ignore the difference): if the rate goes up by 1%, the price of your bond goes down by almost 10%. So we can use duration as a proxy for interest rate risk, hardly ... Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. APY vs Interest Rate: What Is the Difference [Guide for 2022] - Review42 When calculating the interest rate vs APY, you need to multiply by 100 and get to a percentage to find the interest rate. If you multiply 0.053660387 by 100, you find the interest rate equals 5.366% (if the APY is 5.5 %, and interest is compounded monthly). CD Rate and APY: What's the Difference? | Fox Business In today's low interest-rate environment, the difference between the APY and the nominal rate is only a few hundredths of a percentage point. Using Bankrate's tool for comparing CD rates, in...

Interest Rate Swaps Explained – Definition & Example Sep 14, 2021 · How Interest Rate Swaps Work. Generally, the two parties in an interest rate swap are trading a fixed-rate and variable-interest rate. For example, one company may have a bond that pays the London Interbank Offered Rate (LIBOR), while the other party holds a bond that provides a fixed payment of 5%. If the LIBOR is expected to stay around 3% ...

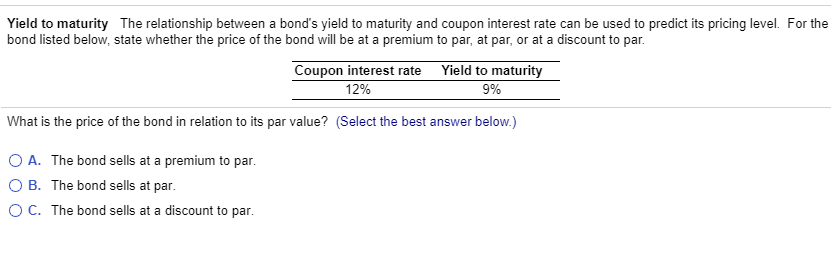

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA Let us discuss some of the major Difference Between Coupon vs Yield: The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date.

Coupon Rate Calculator | Bond Coupon For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate will still stay the same.

As Interest Rates Continue To Rise, Is It Better To Choose a Variable ... Demand for adjustable-rate mortgages has risen in recent months as interest rates for fixed-rate mortgages hit their highest level in a decade. The average contract rate on a 30-year fixed-rate mortgage climbed by 7 basis points to 6.01% for the week ending Sept. 9, Reuters reported, citing data from the Mortgage Bankers Association.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons.

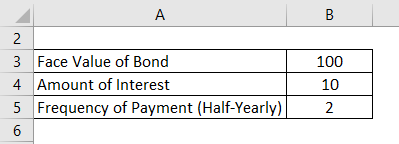

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

Duration: Understanding the relationship between bond prices and ... If interest rates were to fall, the value of a bond with a longer duration would rise more than a bond with a shorter duration. Therefore, in our example above, if interest rates were to fall by 1%, the 10-year bond with a duration of just under 9 years would rise in value by approximately 9%. If rates were to fall 2%, the bond's value would ...

Coupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

Today's 10- and 15-year mortgage rates continue to offer best money ... With rates for longer terms resting well over 6%, 10- and 15-year rates will offer homeowners lower interest costs over the life of a loan. But with 20-year rates remaining higher than 30-year ...

What is difference between coupon rate and interest rate? The coupon rate is calculated on the face value of the bond which is being invested. The interest rate is calculated considering on the basis of the riskiness ...

What is difference between coupon rate and interest rate? The Coupon Rate is 9%. It pays $90 per year since it was issued $90 is 9% of the original $1000 investment. The Bond Yield (aka, Current Yield) is 10%. 10% is your return this year, if you buy the bond at today's prices $90 is 10% of your $910 investment. The Yield to Maturity (YTM) is 13%. It's the only number that really matters.

Discount Rate vs Interest Rate | 7 Best Difference (with ... The interest rate will be higher if the borrower’s profile is considered risky, the rate of interest charged on them will be on the higher side. Head to Head Comparison Between Discount Rate vs Interest Rate (Infographics) Below is the top 7 difference between Discount Rate vs Interest Rate:

Interest Vs. Dividends: Definition, Pros & Cons - Business Insider Investing $1,000 in a one-year CD at a rate of 3% would yield $30 in simple interest over the term, plus your initial $1,000 investment. Not the greatest return, but it's guaranteed.

Difference Between Coupon Rate and Interest Rate In contrast, interest rate is the percentage rate that is charged by the lender of money or any other asset that has a financial value from the borrower. The main difference is that the decider of these rates; the coupon rate is decided by the issuer whereas the interest rate is decided by the lender.

APR Vs. Interest Rate: What's The Difference? | Bankrate APR stands for annual percentage rate, and it represents the cost of your mortgage by including the interest rate and some other fees and closing costs. APR is not the same as your interest rate ...

Chapter 6 -- Interest Rates - California State University ... interest rates Interest rate price risk: an increase in interest rates causes a decrease in bond value Interest reinvestment risk: a decrease in interest rates leads to a decline in reinvestment income from a bond (2) If the required rate of return (or discount rate) is higher than the coupon rate, the value of the bond will be less than the ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity. Prevailing interest rates may rise or...

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "43 coupon vs interest rate"